EOFY Property Tax Deductions Playbook 2025

As the End of Financial Year (EOFY) approaches, Australian property investors are at a crucial point in their annual financial planning. With tax returns due soon, property investors must prepare and lodge their tax return, which includes both individual tax return and business tax return obligations depending on their business structure. Now is the time to ensure every eligible deduction is claimed to improve your bottom line. One of the most significant yet often unused deductions is tax depreciation, which is a major expense for many investors. Tax depreciation applies to both residential and commercial properties and having a current tax depreciation schedule can make a substantial difference to your cash flow.

Acting before the EOFY is important. The end of the fiscal year is an important time for businesses to review their finances, ensure all payments are up to date, and prepare for the year ahead. By reviewing your property portfolio and tax depreciation assessment now, you can optimise deductions, reduce taxable income, and increase your annual cash flow. This guide is designed for investors, real estate professionals, accountants, property developers, small business owners, and SMSF trustees who want to make the most of their property assets as the financial year ends.

What is Tax Depreciation and Why Does It Matter?

Tax depreciation, in the context of investment properties, is a deduction you can claim for the wear and tear on your property’s structure and its assets over time. The Australian Tax Office (ATO) allows investors to offset this ‘decline in value’ against their rental income, reducing the amount of tax payable each year.

A tax depreciation schedule is a report that details all eligible deductions for both the building structure (capital works) and plant and equipment (such as carpets, air conditioners, and appliances). A registered quantity surveyor is generally recognised as the appropriate professional to prepare a compliant schedule under ATO requirements. Depreciation is a non-cash deduction, meaning it does not require you to spend money each year, but it can improve your cash flow by lowering your taxable income. Accurate financial statements, including profit and loss statements and balance sheets, are essential for substantiating claims and ensuring compliance with tax purposes.

Who Needs a Tax Depreciation Assessment Before EOFY?

Whether you own an income-producing property—be it residential, commercial, industrial, retail, mixed-use, or specialised such as healthcare, hospitality, or agricultural—a tax depreciation assessment can deliver significant financial benefits. Even older properties can offer substantial deductions, especially if you’ve carried out renovations, upgrades, or fit-outs. Regardless of the type or age of the property, maximising depreciation can improve your cash flow and overall investment return.

Many investors are surprised to learn that upgrades to kitchens, bathrooms, or flooring can significantly increase their claimable depreciation.

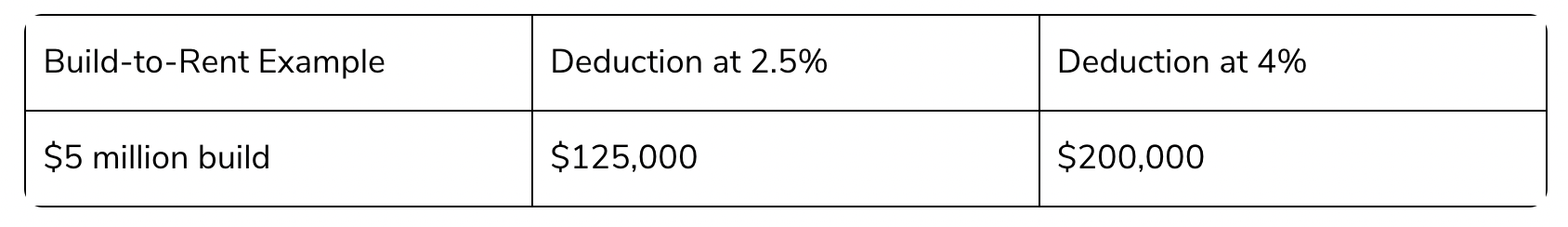

If you own shops, offices, or other commercial buildings, the scope for depreciation claims can be even greater. For eligible build-to-rent developments that commenced construction after 9 May 2023, the capital works deduction rate has increased from 2.5% to 4%. This means a $5 million build-to-rent project can now claim $200,000 annually in deductions at the new rate, compared to $125,000 under the previous rules.

Home Offices and Shared-Use Assets

If you use part of your home for business, you may be able to claim depreciation on the relevant portion, including furniture, technology, and fit-outs allocated to business use.

Property Developers and Small Business Owners

Developers can claim depreciation on both the construction and plant and equipment in new builds. Small business owners who lease or own their workspace are also able to claim deductions for fit-outs and improvements. Businesses should ensure all relevant financial information, such as business activity statements and super guarantee contributions, are included when preparing their annual tax return.

SMSF Trustees

Self-managed super funds (SMSFs) with income-producing property can claim depreciation, which reduces the fund’s taxable income and boosts long-term returns.

The Financial Benefits of a Tax Depreciation Schedule

A professionally prepared depreciation schedule can reduce your taxable income each year. Schedules for capital works typically cover up to 40 years of deductions, maximising long-term benefits. If you have missed previous claims, it is generally possible to backdate and amend returns for up to two years, so you may still be able to claim unclaimed deductions, depending on your circumstances and ATO rules.

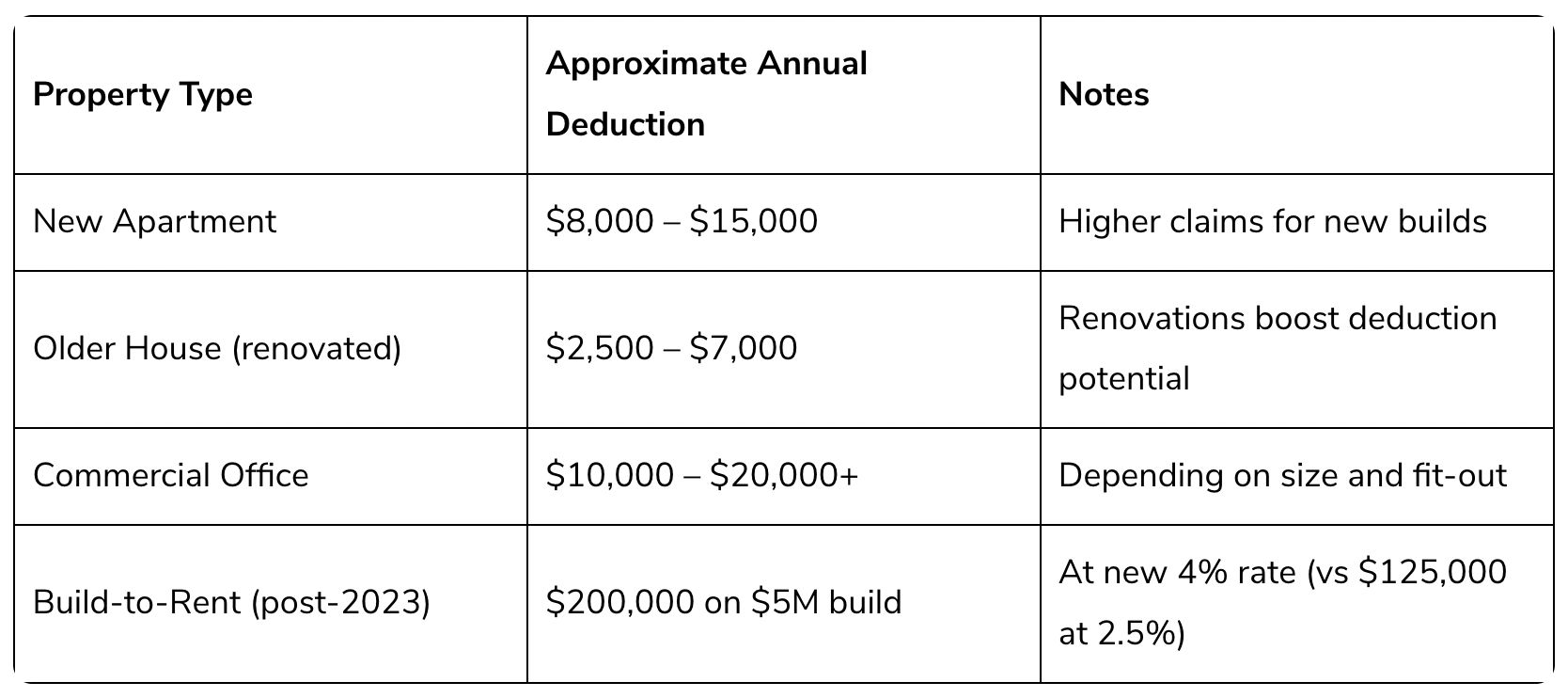

Depreciation can increase annual cash flow for many investors. Here is an indicative breakdown of potential yearly deductions for different property types (actual amounts will vary based on property specifics, construction date, and fit-out):

These figures highlight the potential value of a tailored tax depreciation assessment before EOFY. Reviewing other relevant financial information, such as payments made and received, is crucial for accurate financial reporting and maximising tax deduction claims.

How to Prepare for EOFY: Action Steps for Investors

Gather all relevant property records, including purchase contracts, renovation details, and receipts for capital improvements.

Engage with a registered quantity surveyor to prepare or update your tax depreciation schedule.

Review your current claims with your accountant to ensure all eligible deductions are included and you are not missing out on any entitlements.

For new build-to-rent projects, confirm your schedule reflects the increased 4% deduction rate.

If you have missed claims in previous years, discuss amending past returns with your tax advisor – claims can usually be restrospected for up to two years, subject to the ATO’s amendment period rules.

Settle any outstanding ATO liabilities before July to avoid non-deductible interest, charges and ensure smooth processing.

Check all due dates for tax return lodgement, payment of outstanding liabilities, and submission of business activity statements to avoid penalties.

Things to Consider Before EOFY 2025

Get a Capital Gains Tax (CGT) report if you’re thinking of selling or want to assess your investment’s performance.

Buy and install eligible assets under $20,000 before 30 June to claim an immediate tax deduction.

Make sure your landlord and building insurance are up to date and reflect any recent upgrades or changes.

Add any renovations, improvements, or new assets to maximise your depreciation deductions.

If your investment property is held in a self-managed super fund, check that all eligible claims are included.

Finish any deductible repairs or general maintenance before EOFY claims them this financial year.

Consider buying assets that support your investment or business before EOFY to benefit from available tax incentives.

Prepay expenses like interest or insurance where eligible to bring forward deductions.

Keep all receipts, income summaries, and renovation records ready for your tax return.

Common Questions and Misconceptions

Can I claim depreciation on an older property?

Yes, especially if you have completed renovations or upgrades. Even older properties may have claimable deductions.

What items are considered plant and equipment?

This includes carpets, blinds, appliances, hot water systems, and air conditioning units.

Is a depreciation schedule a one-off cost?

Yes, a schedule typically covers up to 40 years of deductions for a specific property.

How do ATO rule changes affect my claims?

The increased build-to-rent deduction rate can significantly increase your annual deductions if your property is eligible.

Can I claim for renovations and additions?

Yes – improvements and upgrades can increase your deductible amount.

How can a tax agent help make EOFY easier?

A registered tax agent can help make EOFY easier by ensuring your tax return is compliant, all relevant financial information is included, and you maximise your deductions while meeting all due dates and payment obligations.

Key Takeaways

Tax depreciation can save you thousands and improve your annual cash flow.

Schedules are valid for up to 40 years and can be updated for renovations or new assets.

Recent ATO changes, including higher build-to-rent deduction rates, make this year especially beneficial for a review.

Claiming retrospective years (up to two years) is possible in many cases if you have missed deductions previously, subject to ATO amendment rules.

Always seek guidance from a registered quantity surveyor, your accountant, and informed real estate agents for the best EOFY results.

Taking advantage of EOFY deals, such as eofy sales on home appliances, office supplies, and favourite brands, can help investors find the best deals and maximise savings during the financial year sale period.

Reviewing your business income, profit and loss statements, and ensuring all relevant financial information is included in your annual tax return, will help you stay compliant and set your finances up for the year ahead.

Source: Tuan Duong, duotax.com.au